November 15, 2023

Introduction

Often in the UK, renewable energy generating stations produce more electricity than they can consume onsite. As a result, the renewable energy generator/operator exports the excess electricity from the technology – for example, their wind turbine, solar photovoltaic (PV) panels or hydro turbine – to the grid.

This exporting of excess electricity is generally managed via a Power Purchase Agreement (PPA), whereby a licenced electricity supplier offers the renewable energy generator a price for their exported electricity, usually in the form of a 6 month – 12 month contract. This can be arranged through a fixed price option or a variable price based on the System Price.

Prices vary from year to year according to global factors and the electricity market is extremely volatile where within-day pricing movements occur regularly. With such volatility many generators often ask when is the best time to lock-in a price or why are prices are where they are?

What determines PPA prices?

(See previous blog on Zevon website!)

There are a number of factors that affect energy prices and over the last few years since the global pandemic we have seen prices collapse in 2020 then recover in 2022 to record high levels never seen before.

Generators will have benefitted from single digit prices and within 2 years many generators received price offers four times higher than before.

Why such a jump in prices?

As a result of the lockdowns and restrictions on social gatherings during the COVID pandemic many industries suddenly ceased operating which resulted in a major decrease in energy demand. As with the rule of economics as demand falls so does supply.

When lockdowns and restrictions loosened it led to an increase in demand. Large energy users like those within hospitality emerged from social restrictions which led to an increase in demand.

As highlighted in one of our previous blogs, the UK is still reliant on fossil fuels for electricity production. The UK receives the majority of its gas from Norway and not Russia.

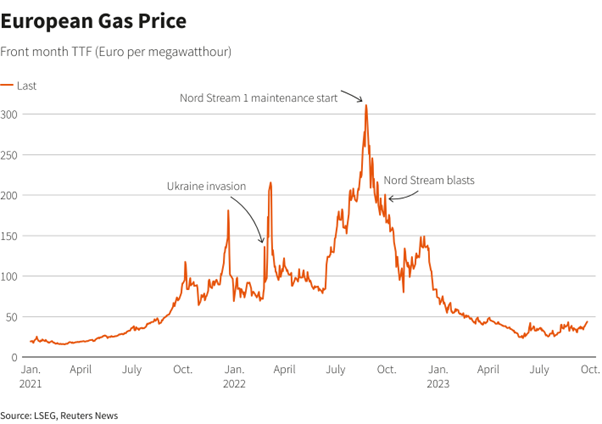

Russia had a gas pipeline supplying gas into Europe for decades called Nordstream, this supplied in the region of 15% of European gas. Nordstream 2 was the second pipleline expected to be opened and commissioned prior to the war with Ukraine and Russia. Geo-political factors there pushed back its commissioning for months. Continuous delays to this project and explosions at multiple locations on the pipeline meant the pipeline did not ever deliver any gas. As a result of the war in Ukraine, Russia turned off its supply of gas into Nordstream 1 which Germany was very reliant on along with other European countries. With reduced flows of gas and increased demand from a cold winter led to higher prices.

The below graph highlights the spikes in European gas prices. This would closely align with electricity prices too.

If you factor in that the COVID pandemic was a global issue and it affected the energy markets across the world in the same way. China, as it moves away from fossil fuels, was relying more and more on Imported gas coming from Europe and further afield. Once that demand increases on a global scale the prices will follow. This led to record gas prices across Europe which were passed through to the end consumer. PPA prices in the UK reached record levels as a result of volatility across Europe.

Why have prices come down so quickly?

Gas storage levels across Europe remained high throughout 2023 which provided much more stability towards electricity prices. High storage levels provided much needed protection against volatility arising from global factors as seen in 2022.

Aside from some minor volatility in the market, which came about as a result of the threat of strike action at Chevron’s LNG port in Australia along with damage done to the Balticconnector pipeline, both gas prices and electricity prices have remained stable since the turn of the year. December 2022 saw a spike in gas prices which was largely due to the cold weather snap we had in the first 2 weeks of the month. The combination of a stretched supply and the need to buy to meet the increase in demand led to a sharp increase in prices ultimately. In addition to that there was very little wind from turbines across the UK and solar radiation is much lower in December so fossil fuels were called on to meet demand. In renewable energy terms the German word for these weather conditions is dunkelflaute.

Where is the market now?

At the time of writing gas storage levels in Europe are at record high levels of 99% of capacity. This will continue to protect the UK from volatility and major shifts in pricing patterns. There is also continued mild weather across the UK which has seen a reduction in demand for fossil fuels compared to previous years. If there is another period of dunkelflaute or low solar radiation or wind output then the gas reserves may be stretched. The conflict in the Middle East could escalate and provide uncertainty to the markets. Should a cold winter arise in Asia, along with China continuing to move away from coal, then the high demand for LNG could result in prices going up in the short term.

Why use Zevon?

If you are interested in discussing your PPA and wish to discuss prices please contact James on 0131 357 5747

References:

Abnett, K et al. (2023) Europe heads more comfortably into winter without Russia’s Nord Stream gas. Available at: Reuters (Accessed 13/11/2023)

Morely, B. (2022) Energy prices: how COVID helped them to surge – and why they won’t go down any time soon. Available at The Conversation (Accessed 6/11/2023)